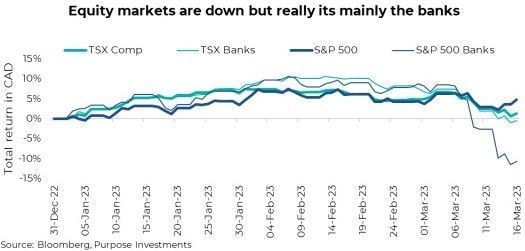

SVB’s demise appears to be more of an asset/liability mismatch that deteriorated as deposits were suddenly pulled. On the positive, the asset side is not overly complex leveraged assets such as CDOs in 2008. Perhaps the real takeaway may be that an extended period of an artificially low cost of capital and too much abundant capital led to an explosion of venture capital growth businesses (small & med sized tech firms and CEOs in their 20s with business plans written on napkins). Now that capital has a real cost (yields up and less abundant access to capital), many of those ventures are proving to be a tad overly optimistic or require continued free and plentiful capital to continue, which no longer exists. So, should we be surprised a bank that primarily focuses on this niche of the technology industry has failed? Or, in Signature’s case, a bank sensitive to the gyrations in the digital asset space? Greater variability in both inflation and economic growth does not encourage higher earnings multiple for equities. Depending on a market's current valuation, this may prove to be a headwind.

Higher rates = higher cost of capital. That is the tide going out, and now poor business models and capital allocations are being punished. It is the circle of life (or the circle of capital). This has highlighted that a diversified deposit base has become extremely important for banks and other lenders. Especially given movements among deposits. The bigger the bank, the more diverse the deposits (usually).

What happens next?

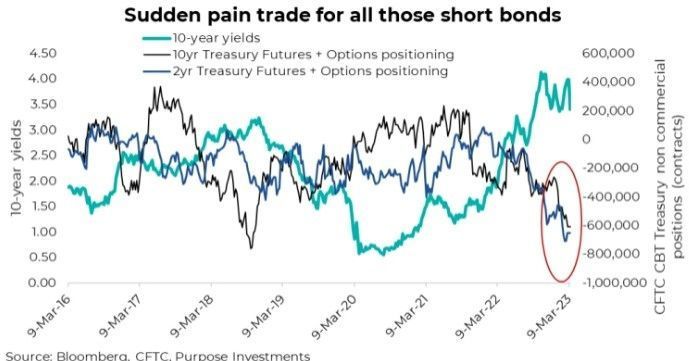

Will there be other shoes to drop or other vulnerable business models exposed? No doubt. The era of easy money has ended, and many companies need to pivot. This will continue to be a challenging period. For the banks, a period of ‘no news’ would certainly be positive and could easily lead to a relief rally. But make no mistake, the stresses of so many rate hikes and higher yields over the past year continue to work their way through the economy and financial system. And while the sudden drop in yields over the past week is welcome, potentially alleviating some stresses, it may be causing stresses elsewhere. At the end of February, the net speculative positioning in the combined options & futures market for bonds was VERY short – making this sudden drop in yields (rise in prices) very painful. Some investment models are clearly feeling this pain now.

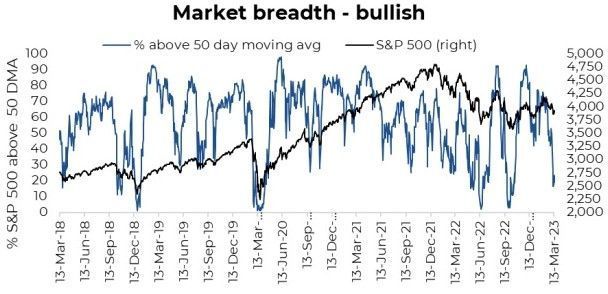

Sticking with the short term, it is worth pointing out that the market appears poised for a bounce. Relative Strength got down to a buy signal on Monday (near 30). Market breadth for the S&P 500, measured by the percentage of companies above their 50-day moving average, is bullish (meaning oversold).

2023

This banking flare-up has not changed our view for 2023, and in fact, it is supporting evidence. Last year inflation was the largest angst for markets, which we believe peaked in the fall. While inflation won’t follow a straight line lower, as evidenced by a small uptick lately, we believe the general path will be down. As inflation fear fades, markets rally. That is what we saw to start the year. But this inflation fear will gradually be replaced by economic/recession fear as the year progresses.

The economic data at the moment is very mixed. We have an inverted yield curve, leading economic indicators that are negative, Fed recession models that are flashing a warning sign, and a drop in asset prices that often precedes a recession.

Meanwhile, on the other side of the economic ledger, we have a consumer in decent shape and a healthy labour market. But these are not leading, more coincidental or even lagging. So if you look out the side window of the bus, everything looks hunky dory…just don’t look out front.

Even if these bank issues fade, there will be an implication for quarters and years ahead. With what has happened, credit just got a lot harder to come by. Banks will continue to become more restrictive and conservative. That is deflationary and will continue to bite into economic growth.

Finally, what do you think it looks like as a recession approaches? Over-levered or vulnerable business models are exposed first. Well, check that box over the past week. And if you had previously given the probability of a recession 50%, which way have those odds moved in March? (hint: higher).

Final Thoughts

Nobody knows if a recession is a certainty in 2023 or even 2024. For us, best to prepare for it and be pleasantly surprised if a recession is avoided. Much better than denying the recession risk with rose-coloured glasses and being surprised if one develops. After reducing international equity and adding to bonds at the beginning of March (Worth a Read or Two), our balanced model is underweight equity and overweight bonds/cash. Plus, we are carrying a nice duration of just over 5 for our bonds. We prefer leaning into defense – bonds, dividend-focused equities and defensive alternatives.

Trade this market turmoil or potential price overreactions if you like, but best to remain a short-term renter.

— Craig Basinger is Chief Market Strategist at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Greg Taylor and Derek Benedet Purpose Investments Inc.

Disclaimers

Echelon Wealth Partners Inc.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional

advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.

Please note that only Ventum Financial is a member of CIPF and regulated by IIROC; Chevron Wealth Preservation Inc. is not. ** Insurance products and services are offered by life insurance licensed advisors through Ventum Insurance Services a wholly owned subsidiary of Ventum Financial Corp.